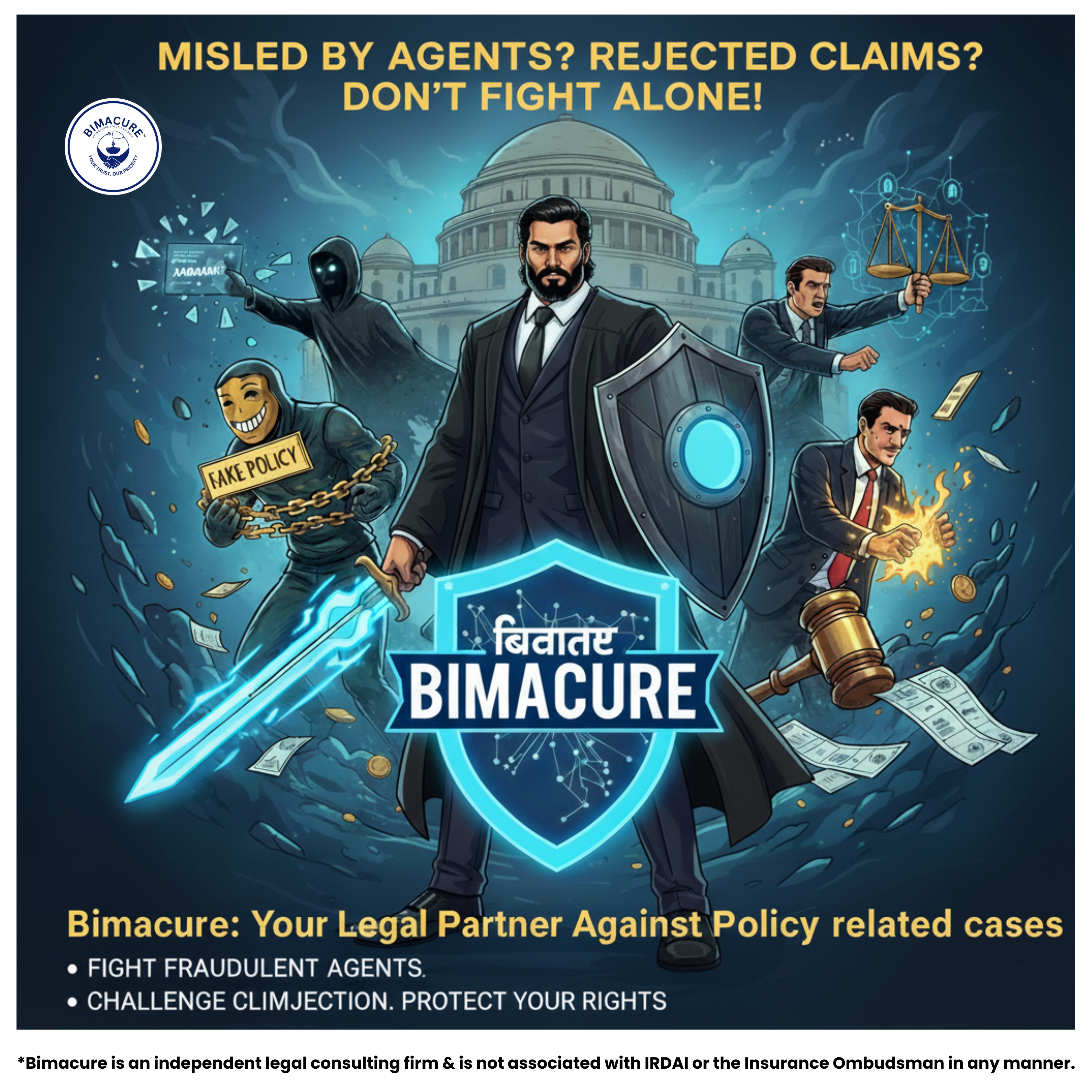

Insurance is meant to give us peace of mind. Unfortunately, scams in the sector are on the rise, and fraudsters are finding new ways to cheat policyholders. If you’ve ever faced claim delays, unfair rejections, or suspected foul play in your policy, you’re not alone. At Bimacure, we work every day with people like you—helping them fight back and recover what’s rightfully theirs.

🔹 Digital Identity Fraud: Fraudsters use fake or manipulated Aadhaar and other digital IDs to buy policies or file bogus claims. In many cases, they even change your registered mobile or email to keep you from receiving alerts.

🔹 Fake Policy Scams: Fraud agents pose as genuine advisors and sell policies that look authentic but carry no real value. Victims often discover the truth only when their claims are rejected.

🔹 Mis-selling: Dishonest agents promise low premiums, guaranteed returns, or unrealistic benefits. The hidden exclusions, waiting periods, and surrender charges come to light only when it’s too late.

🔹 Forged Documents: From fake medical reports to falsified police documents, scammers are using forged paperwork to make false claims, especially in health and life insurance.

🔹 Overbilling: Some hospitals and garages inflate bills for unnecessary or even non-existent services, leading to heavy financial losses.

🔹 Staged Accidents: Motor insurance scams often involve staged or fake accidents to claim money for damages or injuries.

🔹 Fake Recovery Calls: One of the latest tricks—fraudsters impersonate IRDAI or Ombudsman officials. They claim they can recover your “stuck” or “staged” claims but insist you buy new policies first. This trap keeps victims stuck in a cycle of fraud.

At Bimacure Legal Consulting, we don’t sell insurance—we protect people from fraud, mis-selling, and unfair practices. Here’s how we can help:

✔ Fraud Detection: Our experts analyze your policies and claims, spotting red flags or manipulated documents.

✔ Claim Rejection Support: We prepare strong legal responses to challenge wrongful rejections.

✔ Accountability: If you’ve been mis-sold or tricked into fake policies, we help you file complaints and take action against fraudulent intermediaries.

✔ Legal Guidance: We guide you through filing with IRDAI, the Insurance Ombudsman, or even Consumer Court—ensuring every step is done right.

✔ Empowerment: We equip you with knowledge to avoid future scams and protect your rights.

If you suspect fraud or have faced claim issues, here’s how to take action with Bimacure by your side:

Collect Your Documents: Keep your policy papers, claim forms, and any communication with agents or insurers ready.

Contact Bimacure: Visit our Contact Page to share your issue.

Expert Review: Our legal team reviews your case and identifies whether it’s fraud, mis-selling, or wrongful rejection.

File the Complaint: With our help, you can file a complaint to IRDAI, Ombudsman, or Consumer Court effectively and without errors.

Stay Protected: We guide you throughout the process and also help you secure your future policies against such risks.

Don’t let fraudsters or even insurers take advantage of you. With Bimacure’s Insurance Fraud Support, you’re never alone in the fight.

📞 Need immediate help? Reach us at our Contact Page or call us directly at +91 91474 13241

Bimacure – Your Legal Partner in Insurance Disputes.

Disclaimer: Bimacure is an independent legal consulting firm and is not associated with IRDAI or the Insurance Ombudsman in any manner.