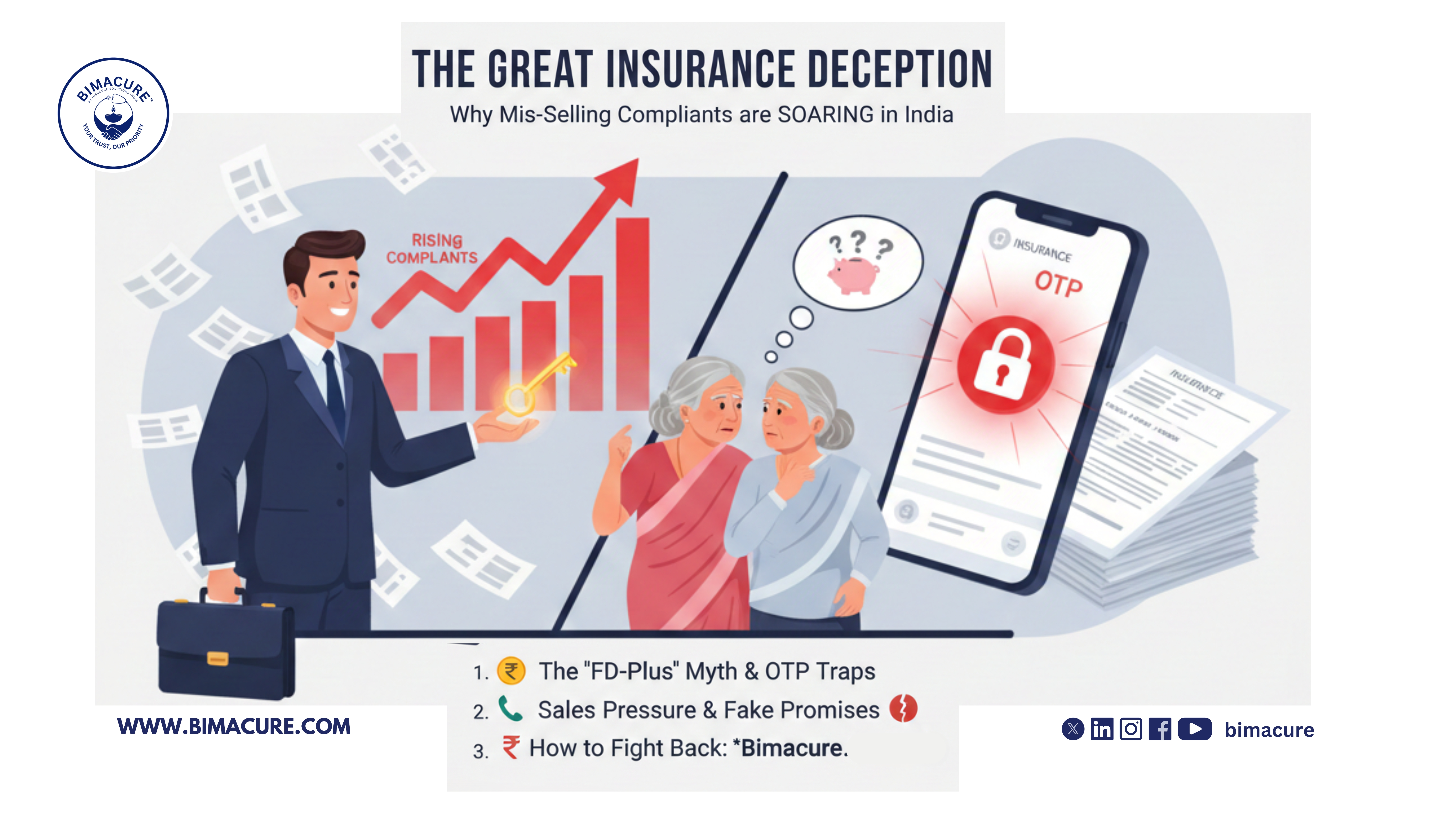

Why Mis-Selling Complaints Linked to Unfair Business

Practices Continue to Rise in India

In the ever-evolving landscape of Indian insurance, a

paradox is emerging. Despite stricter regulations and the 2024–2025 push for

transparency, mis-selling complaints are not just persisting—they are rising.

According to recent industry data, grievances under Unfair Business

Practices (UFBP) jumped by over 14% this year, now accounting for

nearly a quarter of all life insurance complaints.

Why is this happening? Let’s pull back the curtain on the

"Paper–Reality Gap" and explore the systemic drivers of this trend.

1. The Paper–Reality Gap in Insurance Selling

Regulators have introduced mandatory need analysis, benefit

illustrations, and recorded consent. However, on the ground, these safeguards

often turn into a "tick-box" exercise.

2. The 2024 Process Changes: Intent vs. Outcome

In 2024, IRDAI strengthened requirements for signed need

analysis and explicit risk confirmation. While the intent was to empower

the buyer, the outcome has been a more complex onboarding process that

agents often "shortcut" to save time or hide unfavorable terms. The

result is a system that is legally compliant on paper but ethically hollow in

practice.

3. The Real Driver: Sales Pressure and Incentives

At the heart of mis-selling lies a lopsided incentive

structure.

4. Low Awareness and Trust-Based Buying

India remains a "trust-based" market. Many

customers, particularly senior citizens, rely on the verbal word of

their bank manager.

5. Most Common Mis-Selling Patterns Seen on Ground

How Bimacure.com Can Help You Fight Back

If you find yourself stuck with a policy that was sold under

false pretences, you don't have to navigate the complex legal corridors alone. Bimacure.com specializes in

helping policyholders resolve grievances related to mis-selling and unfair

business practices.

Whether it is recovering your hard-earned money from a

mis-sold plan or dealing with a rejected claim, the experts at Bimacure.com

provide the technical and legal guidance needed to represent your case

effectively to insurers and the Insurance Ombudsman. They bridge the gap

between the victim and the resolution, ensuring that "Unfair Business

Practices" don't go unchallenged.

6. What Needs to Change to Reduce Mis-Selling?

To move beyond "paper compliance," the industry

needs a structural overhaul:

Frequently Asked Questions (Q&A)

Q: Why are mis-selling complaints increasing despite new

regulations? A: Most regulations focus on documentation

rather than incentives. As long as sales targets remain aggressive,

agents find ways to bypass procedural safeguards.

Q: How does OTP-based consent contribute to mis-selling?

A: It simplifies the process for the agent. Instead of explaining a

10-year lock-in, they may simply ask for an OTP to "activate the

account," which the customer provides without realizing they are signing a

contract.

Q: Can I get my money back if I was mis-sold a policy?

A: Yes, if you can prove unfair business practices, you can approach the

insurer’s grievance cell or the Ombudsman. Platforms like Bimacure.com

can assist you in building a strong case for a refund.