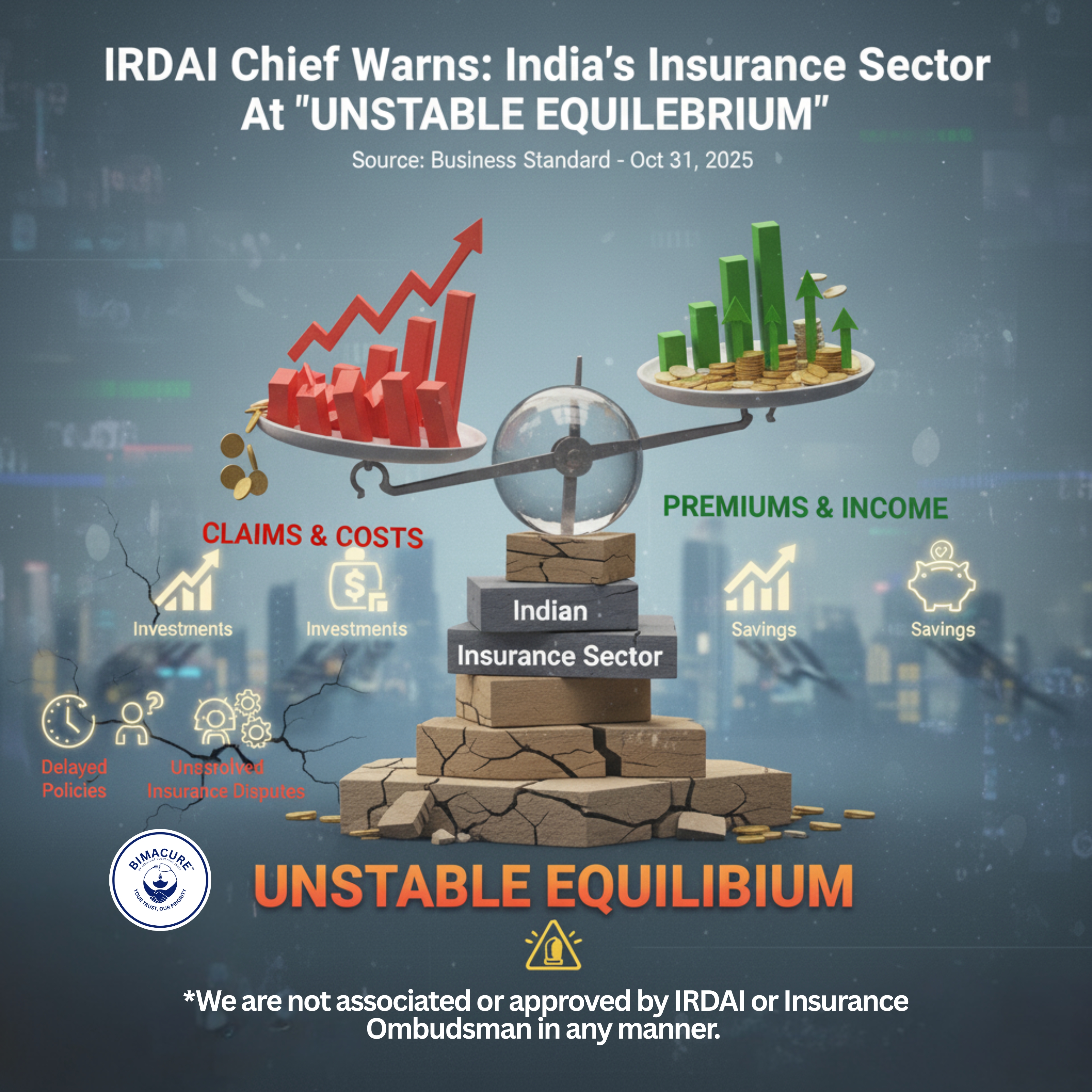

The head of India's top insurance regulatory body has issued a serious warning that directly impacts every person with a life or health insurance policy in the country. The Insurance Regulatory and Development Authority of India (IRDAI) has officially described India's insurance sector—with particular emphasis on health and life insurance—as being at an "unstable equilibrium."

This isn't just a technical term; it's a critical signal indicating that the very foundation of how insurance operates in India is under significant stress.

In simple terms, "unstable equilibrium" means the current state of balance within the insurance industry is precarious and susceptible to disruption. Minor shifts can lead to significant, negative consequences. According to the IRDAI, this instability is being driven by three primary forces that are actively reshaping the industry:

Rising Claim Costs: The cost of settling claims, particularly in the health insurance segment, continues to climb. Factors like medical inflation, advanced treatments, and increasing utilization are putting immense pressure on insurers' finances.

Inefficient Structures: The underlying operational frameworks and processes within the sector are flagged as inefficient. This can include anything from administrative overheads to outdated systems that add to the cost of doing business and ultimately impact policyholders.

Competition from Other Financial Instruments: The insurance sector, especially life insurance which often doubles as a savings tool, faces stiff competition from other investment avenues. This competition can sometimes divert focus from core risk coverage to product pushing, further straining the sector's health.

At Bimacure, we witness firsthand the direct consequences of this "unstable equilibrium" on real people. The theoretical challenges articulated by the IRDAI translate into very tangible problems for consumers:

Delayed Claims: Due to financial pressures and inefficient processing, policyholders frequently experience frustrating and often critical delays in getting their legitimate claims settled.

Mis-sold Policies: The drive for sales in a competitive environment can lead to instances where policies are sold without a clear understanding of the customer's needs, resulting in policies that don't offer adequate coverage or benefits.

Unresolved Insurance Disputes: When problems arise—be it a claim denial, a policy issue, or a service complaint—policyholders often find themselves entangled in complex and lengthy disputes, struggling to find satisfactory resolutions.

The IRDAI Chief's warning is a clear call to action for the industry and a critical alert for consumers. An unstable sector can lead to:

Increased premiums without a proportional increase in benefits.

More stringent terms and conditions for policyholders.

A general erosion of trust in insurance as a reliable financial safety net.

It is more crucial than ever for policyholders to be vigilant, understand their policies thoroughly, and know where to turn if they face issues.

Facing Delayed Claims, Mis-sold Policies, or Unresolved Insurance Disputes?

Don't navigate the complexities of an unstable insurance sector alone. At Bimacure, we're dedicated to helping individuals resolve their insurance-related challenges.

Helpline: +91 62919 36519 | +91 91474 13241

Website:

Source: Business Standard - "Insurance sector is currently at unstable equilibrium:,IRDAI chief" (Published on October 31, 2025)

We are not associated or approved by IRDAI or Insurance Ombudsman in any manner.